on

November2024 - HedgeFund | Management Fee & Incentive Structure

Hedge Fund AUM, Management Fee and Incentive Fee

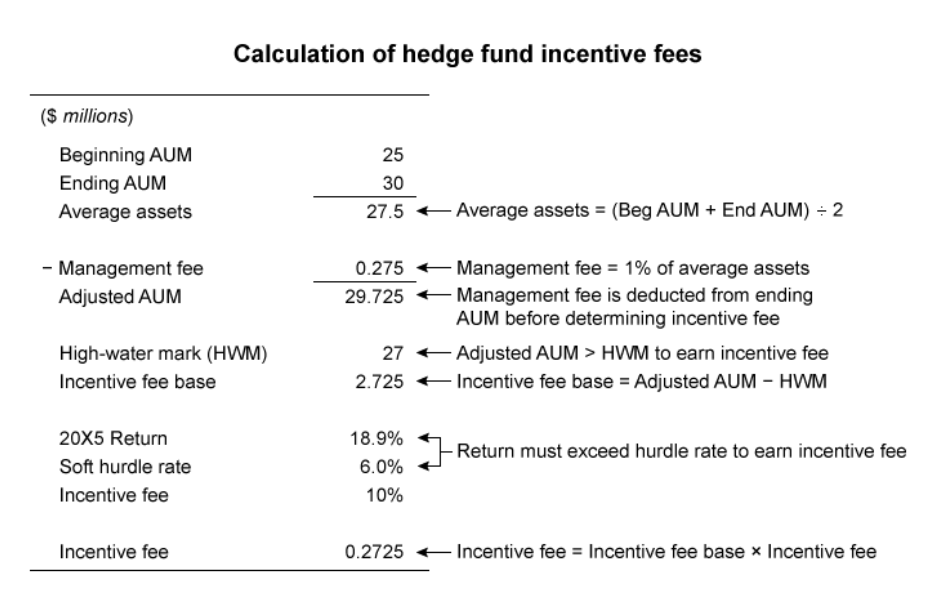

Hedge funds charge both a fixed management fee and a variable incentive fee. The incentive fee is contingent on whether the fund earns a profit and may be subject to a high-water mark and hurdle rate.

At the end of 2024, a hedge fund had $25 million in assets under management (AUM). The fund has the following fee structure, high-water mark, and 2025 results:

Selected Data Management fee (average assets) 1% Incentive fee (net of management fee) 10% Soft hurdle rate 6% High-water mark (millions) $27 Year-end fund assets 20X5 (millions) $30

Problem Statement How will you calculate the Incentive Fee in $ (Assuming no inflows or outflows) earned by this hedge fund for 2025 is closest to: Ans. 272,500

Explanation Hedge funds charge a management fee and an incentive fee. The management fee is calculated as a percentage of the total value of the fund’s assets under management (AUM). It is assessed each year regardless of profitability.

The incentive fee is levied against the fund’s annual gains, subject to certain conditions. It is calculated either gross or net of the management fee. The net calculation subtracts the management fee from AUM to arrive at an adjusted AUM that is used to calculate the fund’s profits.

The high-water mark represents the value of AUM, net of fees, at any time during the fund’s existence. To earn an incentive fee, the fund must exceed the high-water mark, the base from which the fee is calculated.

The hurdle rate is the minimum profit that the fund must earn (usually annually) before it receives an incentive fee. The hurdle rate can either be “soft,” meaning that the incentive fee is calculated based on the entire profit, or “hard,” meaning that the incentive fee is based on only the excess profit above the hurdle rate.

In this scenario, the fund generated net returns in 2025 of 18.9% ( = (29.725 – 25) / 25 ), above the soft hurdle rate of 6%, and eclipsed the high-water mark of $27 million. Therefore, the fund earned an incentive fee of 10% of profits, net of the management fee on average assets of $27,500,000:

Calculation 0.10 × (29,725,000 − 27,000,000) = $272,500.