Written by

Sagun Garg

on

on

October2024 - BTC | Bitcoin Structured Products

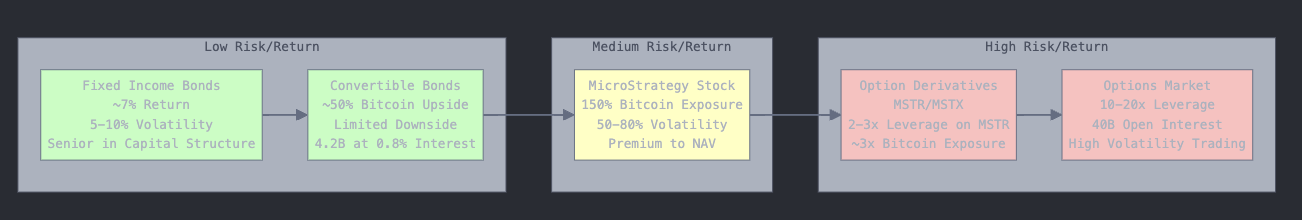

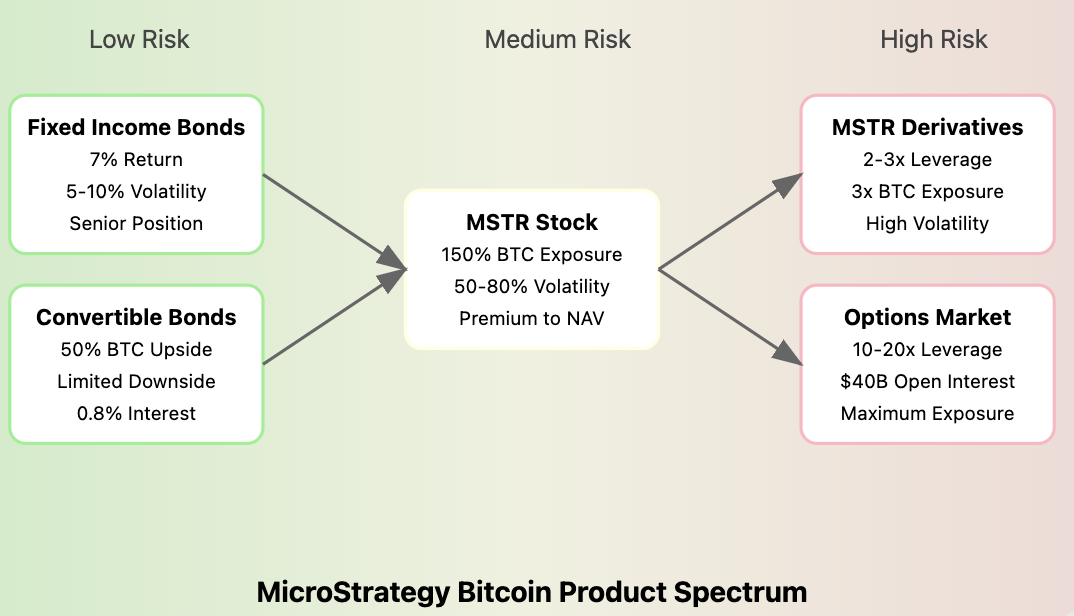

Based on Microstrategy’s offerings different risk profile investors can use different products

Low Risk Products:

- Fixed Income Bonds

- Target: Conservative investors seeking steady returns

- Features: Fixed interest rates around 7%

- Lower volatility (5-10%)

- Senior position in capital structure

- Suitable for fixed income funds and retirees

- Convertible Bonds

- $4.2 billion issued at 0.8% interest

- Offers ~50% of Bitcoin upside with limited downside

- 4x overcollateralized

- Appeals to risk-averse investors wanting some Bitcoin exposure

Medium Risk Products:

- MicroStrategy Stock (MSTR)

- Core offering with 150% Bitcoin exposure

- Trades at premium to Net Asset Value

- 50-80% volatility

- Permanent capital structure

- Targeted at long-term Bitcoin believers

High Risk Products:

- Derivative Products (MSTU/MSTX)

- 2-3x leverage on MicroStrategy stock

- Approximately 3x Bitcoin exposure

- Higher volatility than underlying stock

- For sophisticated investors seeking amplified returns

- Options Market

- Up to 10-20x leverage

- $40 billion in open interest

- Extremely high volatility

- For “degenerate traders” seeking maximum exposure

- Both long calls and short puts available

This spectrum allows MicroStrategy to serve as a “Bitcoin securities company” that can transform “crude” Bitcoin capital into various financial products matching different risk appetites and regulatory requirements in traditional finance.

The diagram illustrates:

- A gradient background representing increasing risk levels from left to right

- Five main product categories organized by risk level

- Key characteristics and metrics for each product

- Arrows showing the progression and relationships between products

- Clear separation between low, medium, and high-risk offerings

The visual layout helps demonstrate how MicroStrategy has created a complete ecosystem of Bitcoin-based financial products catering to different investor profiles, from conservative fixed-income seekers to aggressive traders seeking maximum leverage.